The real estate market in Charleston is almost unrecognizable from the market that we saw earlier this year. What are we seeing? Homes remain on the market for more than double the amount of time as they were earlier this year. Buyers have time to consider more homes, build offers that suit their needs, and participate in negotiations with the sellers. Sellers are often entertaining offers with contingencies, with some even offering to pay buyer’s closing costs and make repairs.

The median days on market in September of 2021 was four, meaning that the majority of homes were going under contract within four days of listing. The same was true throughout much of this year, with an increase to 7 days in August. As of September 2022, a mere two months later, we’re seeing median days on market at 9 days. There are fewer buyers on the market with rising interest rates – buyers can qualify for less house than they would have with lower rates. Sellers may have to offer some concessions to these fewer buyers in order to go under contract relatively quickly.

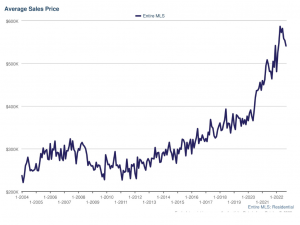

Homes prices are adjusting down as well. Most of the homes on market are closing at list price, if not slightly below. We’ve seen the average sale price for the area steady, with the average price point being $540,722, down from the peak in April of this year which was $586,566. This decrease is mainly due to the fact that homes aren’t being priced over their value. This was a trend over the past two years as home values were increasing so rapidly that many listing agents would price the home at what they could expect it to sell for rather than its true value. We are seeing some price reductions attribute to the decrease as well, but these are often homes that have been overpriced at listing. While experts expect home values to increase another 4% over the next year, that additional equity will come at a much slower pace.

Inventory continues to climb, and while the number of available homes is just shy of 50% of the average month’s supply, we’ve seen a steady increase in the number of homes listed for six consecutive months. This is a far cry from the twelve consecutive month decline we saw from 2021 to early 2022.

What does all of this mean? While some people compare the current state of the market to the housing market crash in 2008, we can tell you that this market is an entirely different scenario. When the crash hit in 2008, there was a huge excess of homes on the market, lowering demand. Still with historically low inventory, demand for homes in incredibly high despite the increase in interest rates.

Everything we see in the market currently is showing that we are headed towards a more balanced market, not an economic crash.