Most experts all agree that the housing market is not currently in a bubble. While on the surface, the housing market may seem like the 2008 housing crisis to those that experienced it, the two markets could not be more different.

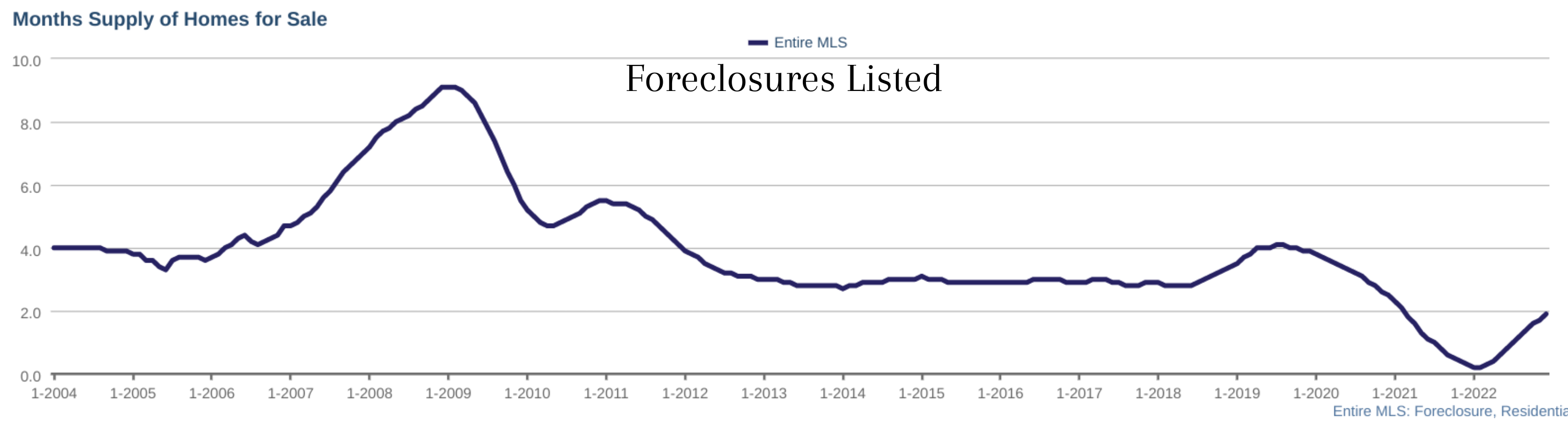

One of the main contributing factor to the 2008 crash was poorly regulated lending. Loans were given to people without being properly vetted. When demand for homes decreased, the supply was still high, meaning there were fewer buyers to purchase these homes. Home prices began to decrease significantly, below the price that they were purchased at. This put many homeowners in the red, unable to sell their homes for enough money to even break even on their mortgages. Foreclosures and short sales were abundant on the market.

What’s shielding us from another “burst”?

After the 2008 crisis, the government got serious about preventing another event like it from happening. Lending laws for credit companies and mortgage lenders became stricter and more regulated, also increasing the standards required for qualifying for these loans.

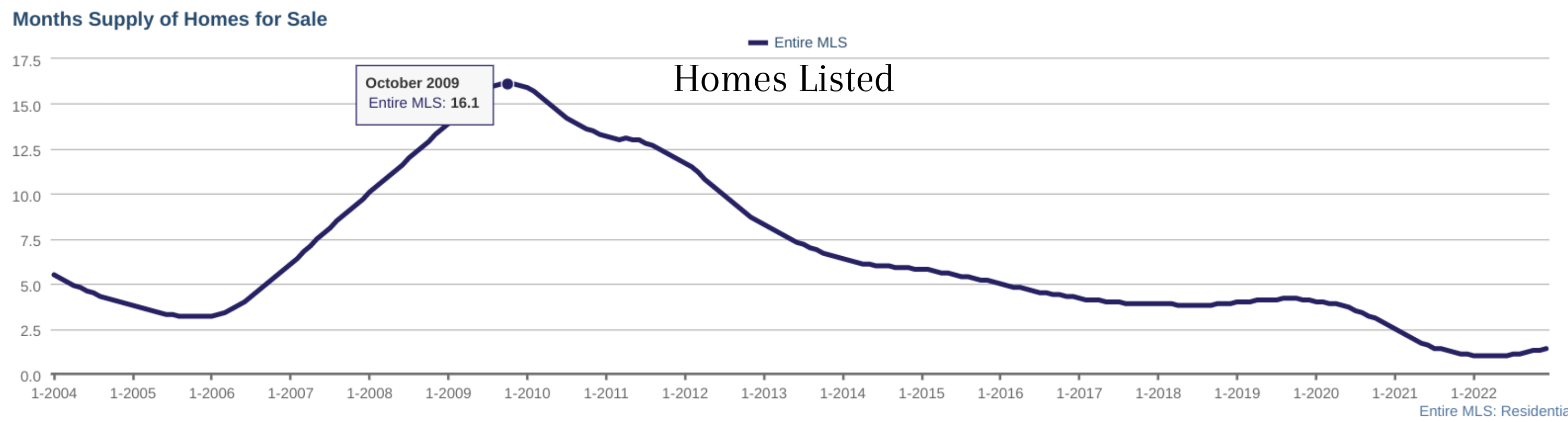

While our current market is seeing a seasonal decrease in demand, we still have limited inventory as a result from the previous two years rather than an extensive inventory in 2008. From 2020 to 2022, we saw record-lows in interest rates, meaning that people were able to qualify for mortgages at a lower overall price. These 2-3% interest rates sparked a real estate ‘frenzy’, where homes were essentially ‘flying off the shelves’. Inventory is still historically low, though we are seeing more homes come onto the market at a steady rate.

In this graph, there is a stark difference between supply between 2008 and 2022. In 2008, we see the highest point on the graph, showing the most properties for sale on the market. In 2022, we see the lowest point of inventory on the market, where we still have little increase.

The number of foreclosed properties depicted in this graph show an excessive amount of foreclosures in the 2008 market, while in our recent markets, we’ve seen very few. With the recent increase in the average home value, homeowners, even those who purchased between 2020 and 2022, have significant equity in their homes to shield them from foreclosure. Their homes are still worth more than or equal to what they paid for them, meaning even if they were unable to keep the home, they would be able to sell the home and break even or make a profit.

The lending regulations and reform put in place after 2008 have provided more stability and security for lenders and borrowers alike. Banks have to hold more in reserve to be able to withstand any severe downturns in the market and borrowers are subject to an intense review of their financial ability to pay for a home before money changes hands.

What can we expect in 2023?

We can expect a much more “normal” market in 2023. Prices are not expected to make a sharp drop and inventory is expected to continue to increase. Interest rates will likely hover around their current percentages and have a slower increase as we make our way through the year.

The days of volatility are in the past. The market of 2023 should regain some sense of normalcy, which time to gather reliable information and make the best decisions for you.

Authored by Nicole Hein